UNAFFORDABLE UTAH

Unaffordable Utah: Beehive State Ranks #10 For Most Household Debt

Apr 8, 2019, 10:32 PM | Updated: 10:37 pm

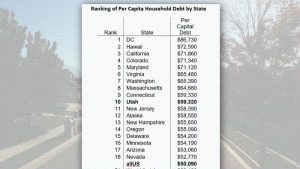

SALT LAKE CITY, Utah — Utah households are racking-up debt faster than the national average with the state now ranking tenth in the nation for highest debt, according to the Federal Reserve Bank of New York.

The bank’s 2018 per-capita debt ranking puts $59,320 of debt on each adult resident’s shoulders. That number includes mortgages, auto loans, credit cards and home equity lines of credit. Utah is well above the national average of $50,090.

“We see debt levels going up for the average family,” said Robert Spendlove, a senior economist for Zions Bank.

In 2018, total household debt in Utah reached $128.8 billion. The bulk of that, 77 percent, is made up of mortgages, 9 percent is due to car loans, student loans account for 8 percent, followed by 6 percent from credit cards.

“We see debt levels going up for the average family."

NEXT on @KSL5TV at 10 p.m., find out how household debt has changed since the recession. #Utah is now tenth in the nation for per-capita debt. @KSLcom @kslnewsradio pic.twitter.com/MyJwWDAeQv

— Ladd Egan (@laddegan) April 9, 2019

Spendlove said he is most concerned about Utahns’ ballooning mortgages, auto loans and student loan debt.

“In the last five years, average mortgage payments have gone up by over $700 a month,” he said. “That $700 more a month literally eats into that family’s disposable income.”

Younger families trying to establish themselves are really struggling, Spendlove said.

“They have a big student loan and then they get a nice car and a credit card and then they want to be able to buy a home and it just becomes more and more difficult,” he said.

Families Struggling

“I am seeing a really big uptick in the amount that people are having to pay for their vehicles,” said Miranda Vance with Fair Credit Foundation.

As a credit counselor and educator, Vance said she is tracking the same problems as Spendlove. She reports seeing unmanageable debt even in Utah families with great incomes.

“Carrying debt is not limited to any income level,” she said. “We tend to feel a lot shame and embarrassment and isolation when we are in debt.”

During the recession, bankruptcy attorney Abraham Smoot saw a lot of issues with payday loans, credit cards and bad mortgages. Now, families are struggling with medical bills and student loans.

“It’s massive. Most people that come into my office are sitting at 30, 40, 50-thousand dollars of student loans,” Smoot said. “That’s a lot of money to pay when you don’t get a great job to pay them back with.”

Smoot said the rapid increase in housing prices is hurting renters because landlords are increasing monthly rents.

“Prices have gone up way past the growth in income,” he said.

Digging Out

“I ended up realizing that I owed quite a chunk of money,” said West Jordan resident AJ Collette.

Collette, 29, said he was overwhelmed with medical bills and credit card debt and was seriously considering bankruptcy.

“I have probably almost $10,000 in medical bills today,” he said. “In my addiction, I didn’t care about my finances. I didn’t pay attention to them.”

The father of five has been in recovery from drug and alcohol abuse since 2016 and decided to face his debt head on with the help of Fair Credit Foundation. He’s been meeting with Vance regularly and is slowly climbing out of debt, rebuilding credit and saving money.

“It’s not a lot but it’s a little bit of security for me,” he said, adding that he recently got a promotion at Flourish Bakery in Salt Lake City and no longer needs to work two jobs.

The biggest change, Collette said, is not having to worry every day about his finances and knowing he has a plan.

“I feel better,” he said. “I definitely feel better.”

Collette’s biggest advice to others facing a problem with debt: don’t bury your head in the sand and to negotiate with creditors.

“Reach out, be honest, ask for help and I think that you’ll be surprised,” he said.

Recession’s Effects

“I’m still seeing a lot of people that are carrying debt that they accrued during the recession when they lost their jobs or their income was decreased,” Vance added.

Leading up to the Great Recession, Utah’s household debt increased rapidly and peaked in 2008 at $66,365 (inflation adjusted), according to the University of Utah’s Kem C. Gardner Policy Institute. Household debt in Utah then declined for six consecutive years.

The debt-shedding was not always voluntary, wrote James Wood, the Ivory-Boyer Senior Fellow at the policy institute. In a 2016 research snapshot he detailed how foreclosures, bankruptcies and a stricter lending environment forced Utahns to reduce debt.

Utah’s per-capita debt bottomed out in 2013 at an inflation-adjusted $54,434. But by 2015, Utah residents started borrowing again with household debt increasing 9 percent by 2018.

It’s important to note, Wood said, that the Federal Reserve Bank of New York’s calculation only includes those 18 years and older. That gives Utah a disadvantage in the ranking because of our oversized population of young people.

Utah’s overall young population is another factor for the higher-than-typical debt load, Wood said. Young homeowners have had less time to pay off debt and build equity.

Make a Plan

When it comes to tackling debt, Vance said avoidance is the most expensive option.

“People go years without picking up collection calls or opening mail,” she said.

The first step should be to get a copy of your credit report—even though that sounds scary and embarrassing to those experiencing financial difficulty.

“I have never had somebody regret pulling their credit report,” Vance said. “More often than not, it’s calming. It’s so nice to know what’s ahead of you.”

Next, try to negotiate lower interest rates on credit cards, which will help you pay down the balances faster.

“Make it clear that you want to work with them,” Vance said. “That you want to resolve the debt. They’ll usually do something for you.”

This could also include consolidating or transferring balances to get a lower rate. The same negotiation tactics should be used on any medical debt: ask for financial assistance, debt forgiveness and/or a payment plan.

Once you know what you owe, create a budget. Experts also suggest targeting debts with extra payments—either based off of their high interest rates or low balances. Pay off one and move to the next.

Seek advice from an attorney or credit counselor before dipping into your retirement accounts or your home’s equity to pay bills.

“If you’re going to go try to sell your house to pay your debts or cash out your 401k to pay on your debt because you’re just stressed and everyone’s calling and trying to collect on you, go talk to an attorney first,” Smoot said.