Netflix is axing its cheapest, ad-free plan in the US

Jul 18, 2024, 5:49 PM

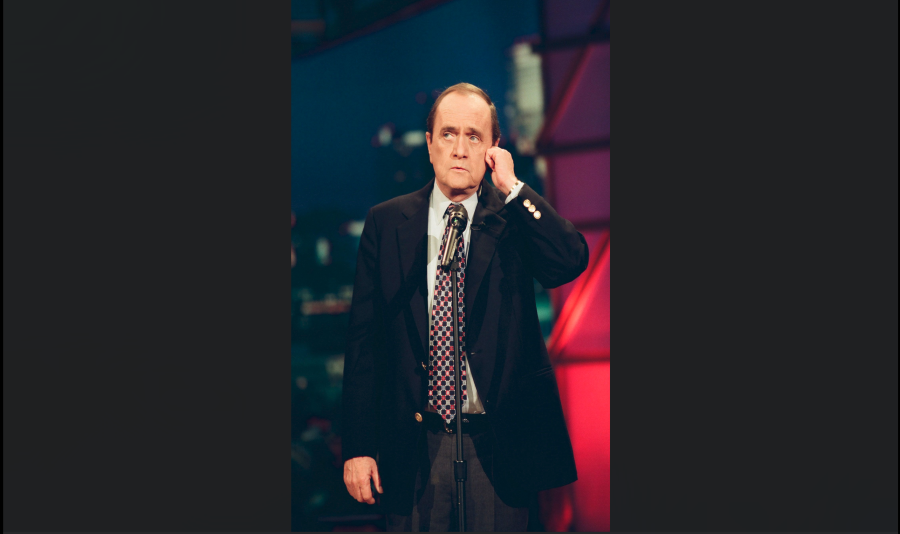

Netflix is pushing further into the world of live sports programming and experiences. (Jay L. Clendenin/Los Angeles Times/Getty Images via CNN Newsource)

(Jay L. Clendenin/Los Angeles Times/Getty Images via CNN Newsource)

(CNN) — Netflix will start phasing out its Basic plan, its cheapest advertising-free plan, which costs $11.99 per month in the United States, the company said on Thursday.

The company had previously stopped accepting new sign-ups for the Basic plan, instead pushing customers to Netflix’s ad-supported plan, which costs $6.99 per month. However, existing users were allowed to keep the basic plan.

In January, the company said it would retire its cheapest ad-free tier in Canada and the UK. On Thursday, the company said the US and France are next.

Basic users in the US who want an ad-free viewing experience on Netflix will now have two choices: Netflix’s Standard plan, which costs $15.49 per month, and its Premium plan, which costs $22.99 per month.

Netflix said its cheapest, ad-supported tier, its “Standard with ads” plan, saw a 34% jump in sign-ups in the second quarter of this year.

The company reported a record-high 277.65 million subscribers on its streaming platform Thursday, far outpacing streaming competitors like Disney+, Peacock and Max (which is owned by Warner Bros. Discovery, CNN’s parent company). Overall, Netflix added 8.05 million new subscribers in its second quarter.

Netflix’s surge in new subscribers has been fueled in part by the company’s effort to push users who share passwords to create their own accounts.

However, the short-term subscriber jolt from the password-sharing crackdown could soon fade. On Thursday, Netflix said it expects the pace of its subscriber additions to slow in the third quarter.

Netflix’s stock fell nearly 2% in after-hours trading, but it has climbed more than 35% in 2024.

The company recently disclosed that it would stop sharing its quarterly subscriber numbers beginning in 2025 in favor of a new disclosure: time spent on the platform.

Netflix, in the past two months, has also pushed further into the world of live sports programming and experiences.

And with Netflix’s recent advance into advertising, the company is starting to look closer to the traditional media companies it seeks to disrupt, said Tim Nollen, a Netflix analyst at Macquarie.

“Whatever the old broadcasters were in their best of times, Netflix is becoming that in a new and probably longer-term, sustainable way,” he said.

The early stages of Netflix’s evolution

Netflix made its biggest sports announcement yet in May. The company made a three-year deal to broadcast the NFL’s Christmas Day games. The deal kicks off this year with Netflix globally airing two NFL games on the holiday. In 2025 and 2026, Netflix will stream at least one holiday game.

“Netflix is now in live sports,” Nollen said. “This means Netflix might be the only place you will be able to watch those two Christmas Day games, which could obviously add more subscribers.”

Airing football games has proven itself to be a winning strategy to juice subscriber numbers: In January, Peacock, NBCUniversal’s streaming service, saw a jump of 2.8 million sign-ups in the three days leading up to its exclusive airing of an NFL playoff game.

The event was “the single biggest subscriber acquisition moment ever measured” by Peacock, according to the company.

Earlier this year, Netflix also announced another high-profile foray into sports programming: A 10-year deal to air “WWE Raw” live, valued at more than $5 billion.

“We’re in live because our members love it. It drives a ton of engagement and it drives a ton of excitement, and those two things are very valuable,” Netflix co-CEO Ted Sarandos said on the company’s earnings call Thursday. “The good thing is advertisers like it too.”

But live sports aren’t the only way Netflix is trying to expand its footprint. Last month, the company said it plans to open two massive entertainment venues called Netflix Houses.

The “experiential” complexes, in former department store locations at Dallas Galleria and King of Prussia mall (near Philadelphia), will each span more than 100,000 square feet and include events, themed gift shops and restaurants. Both will open in 2025.

While these complexes don’t quite reach the scale or footprint of Disney’s or Universal’s global theme parks, David Joyce, an analyst at Seaport, said the complexes are designed to drive brand loyalty.

“It should help retain those customers and keep them in the Netflix ecosystem and paying for their subscriptions for longer,” he said.